Featured News - Current News - Archived News - News Categories

New Legislation to Eliminate "Surprise Medical Bills"

Our labor and employment team represents employers large and small in a wide variety of industries. Whether it is a family-owned small business or a large, multi-national corporation, health insurance is an issue we spend a lot of time working with our clients on.

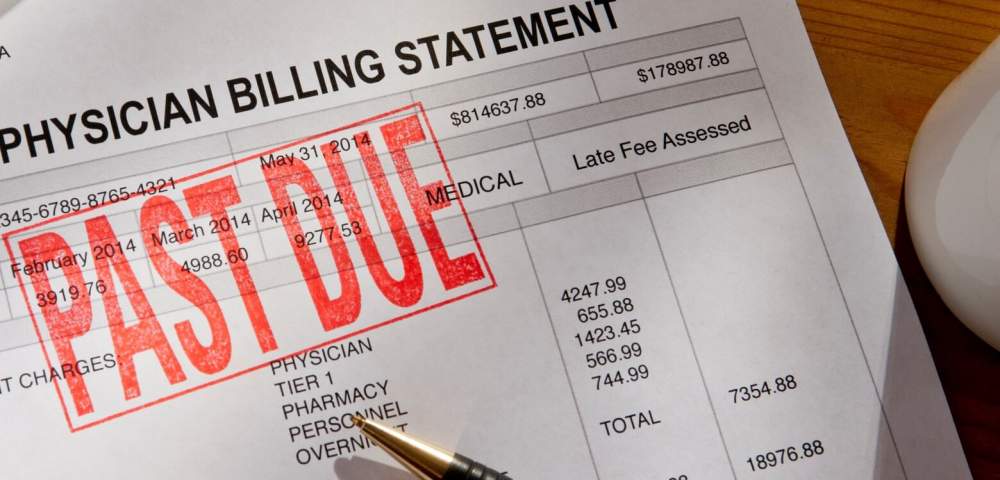

Within that broader conversation is an issue many people can relate to: surprise medical bills. For example, you are on vacation and need to go to the hospital. At your local hospital, such a visit might cost you $150. But on vacation, you are “out of network.”

A month or two after your visit, you could receive a bill for thousands of dollars because you went outside the network. Of course you had no choice, and that has led critics to label these surprise bills everything from unfair, to deceptive to even predatory. That may be true, but until now, charging inflated costs for (at times) arbitrary lists of in-network and out-of-network providers was perfectly legal.

Thanks to new legislation passed in 2020, which will take effect in less than six months, most surprise bills will be a thing of the past. There is a lot covered in the bipartisan legislation, but the key point is this: The new law will require private health plans to cover surprise medical bills for emergency services, as well as out of network provider bills for services rendered at in-network hospitals and facilities.

The law also requires insurance companies to cover surprise bills without prior authorization, and furthermore in-network cost sharing must be used. It also offers appeal options for a patient who feels their insurance provider has not properly paid for a surprise bill. This is a huge shift for consumers, who for years have been victimized by surprise medical bills.

Another common example can occur even when a person receives care at a hospital in their preferred network. A man needs surgery. He selects both a hospital and a doctor within his insurance network. Weeks later, he receives a bill from the hospital because his anesthesiologist was out of network. The patient is not given the chance to choose his anesthesiologist, but he is then penalized, making it one example of an expensive trap in the healthcare system. Under the new rules, such instances will be no more.

So what does this mean for employers? At first glance, it may not seem like it impacts them directly (beyond benefitting as a consumer of their own health insurance). The benefit to employers is more subtle, yet important. The majority of employees purchase their health insurance through their employer. When there is an issue with that insurance (such as a surprise bill) the employee often blames the employer for offering such bad insurance.

Employees may even leave a job not over salary, working condition or job duties, but in search of better health insurance. The surprise bills can be unfairly blamed on the provider of the insurance, the employer, and have a ripple effect in an organization. To that end, the new rules simply smooth out a long-standing pothole in the health insurance process. That makes it a much-needed win for both employees and employers.